GDT Events Oversight Board is an independent oversight body established with an objective to ensure that the trading platform is operated and developed in accordance with the Guiding Principles and to represent the interests of the parties trading on the GDT Events platform.

Access the Charter for the GDT Events Oversight Board and Rulings Panel

The Board comprises an independent chairperson (currently vacant) and a balanced representation of GDT participants including bidders, sellers and financial market members. Oversight Board members meet several times per year to monitor GDT’s compliance with appropriate governance practices and to vote on any proposed changes to the GDT Trading Event Rules.

The Chairperson is an independent third party who is not a current representative or affiliate of GDT, the Trading Manager, any seller, bidder or financial member.

Members

The stakeholder members of the GDT Events Oversight Board comprise three GDT bidder members, three GDT seller members, and three finance and market group members.

The latter reflects the role of GDT prices in the SGX-NZX’s Dairy Derivatives Market.

Appointments are for three years and are based on participant type, trading size and regional location. The current term of the members end on 31 December 2025.

Role of the GDT Events Oversight Board

The primary objective of the GDT Events Oversight Board is to ensure the trading platform is operated and developed in accordance with the Guiding Principles listed in the GDT Trading Event Rules.

The role of the Board includes:

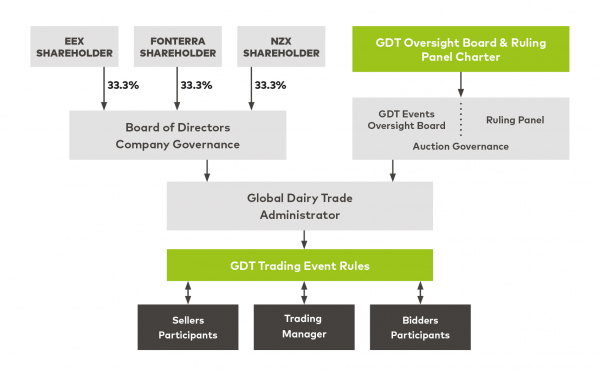

GDT Governance Structure

GDT’s governance structure, illustrated in the diagram below, is designed to provide compliance rigour and effective representation for dairy industry seller, buyers and related financial markets.

Rules governing the GDT Events Oversight Board

The GDT Events Oversight Board is established under Part B of the GDT Trading Event Rules, with rules relating to the selection of members and conduct of meetings detailed in the Charter for the GDT Events Oversight Board and Rulings Panel.

The Charter requires that members act in the best interests of the GDT trading platform and that they observe competition law requirements. These requirements prohibit members from having access to or discussing with other members, any non-public information relating to Trading Events.

Members are prohibited from discussing commercially sensitive or confidential information relating to a member’s business or any proposal that would unfairly affect any bidder or seller. The GDT Events Oversight Board members never receive any non-public information that will give them an advantage over other participants in Trading Events.

Governance Principles

The GDT Events Oversight Board adopted the following Governance Principles to ensure that the conduct of Trading Events is consistent with best practice governance for providers of market-based reference prices.

Minutes of GDT Events Oversight Board meetings

The discussions and decisions made by the GDT Events Oversight Board are published following each Board meeting. The minutes of each meeting are provided in this section.